39 coupon paying bond formula

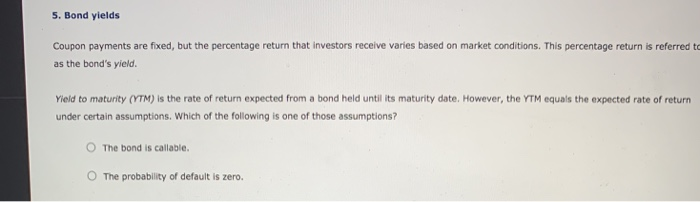

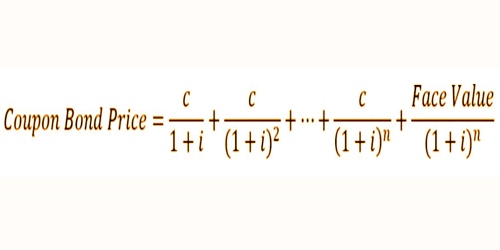

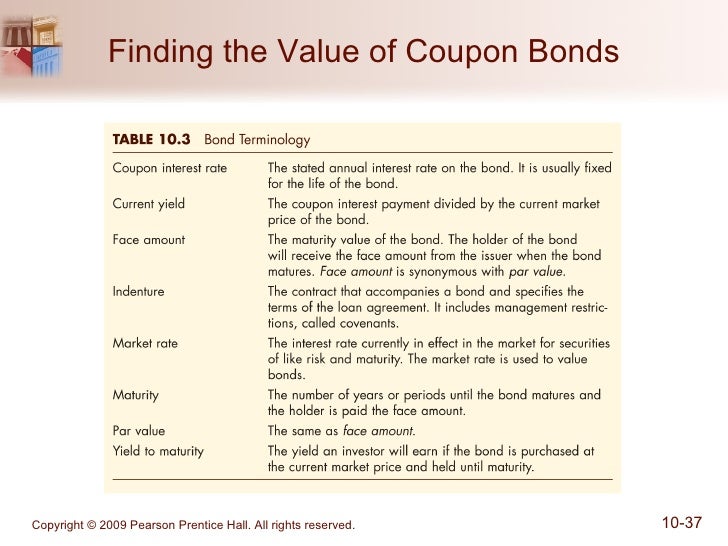

Effective Interest Method - Overview, Uses, Formula The formula used to calculate the effective interest rate is as follows: Where: i = The bond’s coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. n = The number of coupon payments per year (i.e., if coupon payments are received monthly, then n would be 12) Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

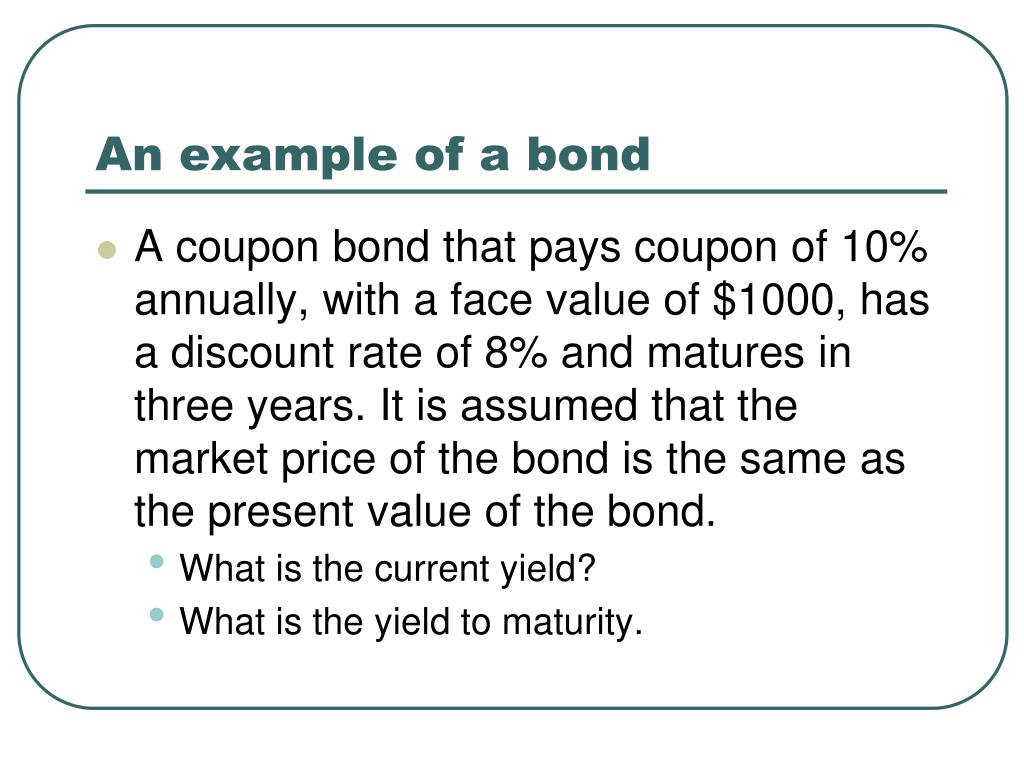

Bond Valuation Overview (With Formulas and Examples) Valuing a bond is a technique that determines the fair value of a particular bond. Many of the characteristics of valuing a stock are present when valuing a bond, including computing the present value of a bond’s future coupon payments. Most investors would relate to cash flow, which is the coupon payments of a bond for valuation.

Coupon paying bond formula

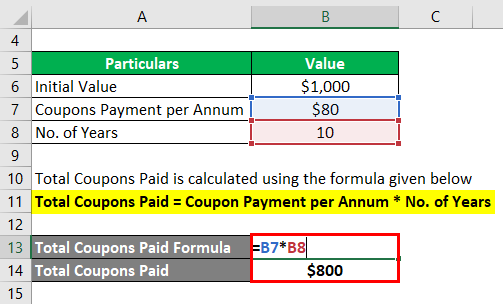

› bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; r = annual yield divided by 2; n = years until maturity times 2; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Annual Return Formula | How to Calculate Annual Return? Annual Return Formula – Example #2. Let us take the example of Dan, who invested $1,000 to purchase a coupon paying bond on January 1, 2009. The bond paid $80 per annum as a coupon every year till its maturity on December 31, 2018. Calculate the annual return earned by Dan during the 10-year holding period.

Coupon paying bond formula. Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; r: The interest rate of the bond; ... So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, ... study.com › learn › zero-coupon-bond-questions-andZero Coupon Bond Questions and Answers | Study.com Calculate your final answer using the formula and financial calculator methods. ... Consider a bond paying a coupon rate of 10% per year semiannually when the market-interest rate is only 4% per ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. It plays a crucial role in generating higher rewards from an investment. read more that will be earned … Bond Value Calculator: What It Should Be Trading At | Shows Work! To illustrate why bond prices and market interest rates tend to move in opposite directions, suppose you purchased a 5-year, $1,000 bond at face value that was paying a 7% coupon rate. Now, suppose market interest rates rise , thereby causing bonds similar to yours to offer, say, an 8% coupon rate.

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac{P}{(1+r)^t} ... So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. Bond Formula | How to Calculate a Bond | Examples with Excel … Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. einvestingforbeginners.com › bond-valuation-daahBond Valuation Overview (With Formulas and Examples) Valuing a bond is a technique that determines the fair value of a particular bond. Many of the characteristics of valuing a stock are present when valuing a bond, including computing the present value of a bond’s future coupon payments. Most investors would relate to cash flow, which is the coupon payments of a bond for valuation.

Zero Coupon Bond Questions and Answers | Study.com Calculate your final answer using the formula and financial calculator methods. ... Consider a bond paying a coupon rate of 10% per year semiannually when the market-interest rate is only 4% per ... How to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% annually with a maturity date in 20 years and a discount rate of 4%. The coupon is paid semi-annually: Jan. 1 ... › zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Annual Return Formula | How to Calculate Annual Return? Annual Return Formula – Example #2. Let us take the example of Dan, who invested $1,000 to purchase a coupon paying bond on January 1, 2009. The bond paid $80 per annum as a coupon every year till its maturity on December 31, 2018. Calculate the annual return earned by Dan during the 10-year holding period.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; r = annual yield divided by 2; n = years until maturity times 2; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term.

› bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Post a Comment for "39 coupon paying bond formula"