38 formula for coupon rate

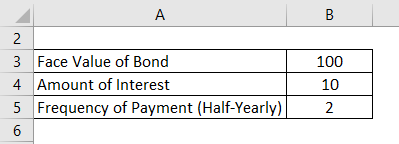

Bond Pricing Formula | How to Calculate Bond Price? | Examples C = Coupon rate * F / No. of coupon payments in a year The total number of periods till maturity is computed by multiplying the years till maturity and the frequency of the coupon payments in a year. The number of periods till maturity is denoted by n. n = No. of years till maturity * No. of coupon payments in a year Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link The bond price varies based on the coupon rate and the prevailing market rate of interest.

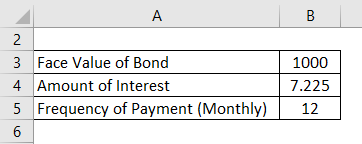

Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula:

Formula for coupon rate

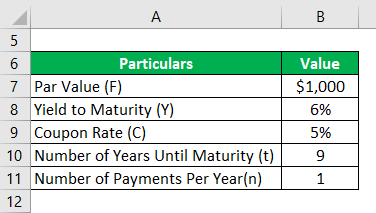

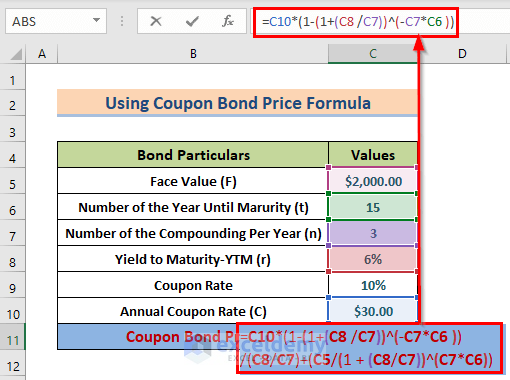

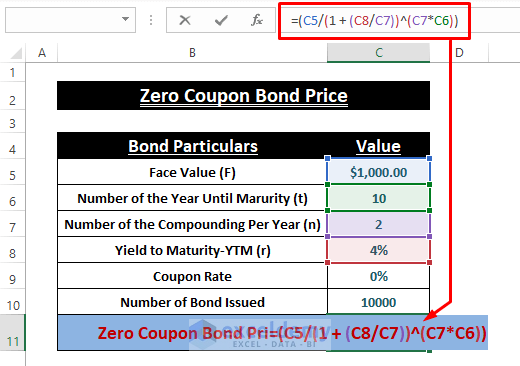

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, YTM = Yield to maturity n = No. of periods till maturity Table of contents What is coupon rate | Definition and Meaning | Capital.com The coupon rate calculations formula is simple. It is calculated by dividing the sum of the annual coupon payments for the security by the bond's par value. Par value determines the bond's maturity value and dollar value of coupon payments. The bond's market value can be higher or lower than its par value, depending on the interest rate ... Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon (C) is calculated using the Formula given below. C = Annual Coupon Rate * F C = 5% * $1000 C = $50 Coupon Bond is calculated using the Formula given below. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $50 * [1 - (1 + 6%/1) -1*9] + [$1000 / (1 + 6%/1) 1*9 Coupon Bond = $932

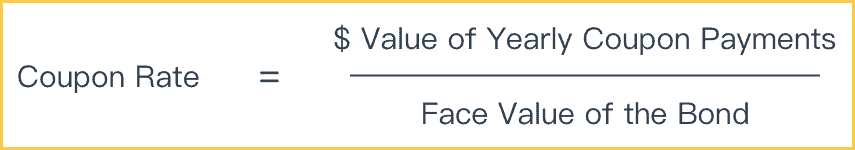

Formula for coupon rate. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder. Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following: Coupon Rate Formula | Simple Accounting If a bond's purchase price is equal to its par value, then the coupon rate, current yield, and yield to maturity are the same. Current yield compares the coupon rate to the current market price of the bond.For example, if a bond with a face value of $1,000 offers a coupon rate of 5%, then the bond will pay $50 to the bondholder until its maturity.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05% Calculate the Coupon Rate of a Bond - YouTube Calculate the Coupon Rate of a Bond 33,837 views Jul 25, 2018 This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon (C) is calculated using the Formula given below. C = Annual Coupon Rate * F C = 5% * $1000 C = $50 Coupon Bond is calculated using the Formula given below. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $50 * [1 - (1 + 6%/1) -1*9] + [$1000 / (1 + 6%/1) 1*9 Coupon Bond = $932

What is coupon rate | Definition and Meaning | Capital.com The coupon rate calculations formula is simple. It is calculated by dividing the sum of the annual coupon payments for the security by the bond's par value. Par value determines the bond's maturity value and dollar value of coupon payments. The bond's market value can be higher or lower than its par value, depending on the interest rate ... Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, YTM = Yield to maturity n = No. of periods till maturity Table of contents

Post a Comment for "38 formula for coupon rate"