40 price of coupon bond

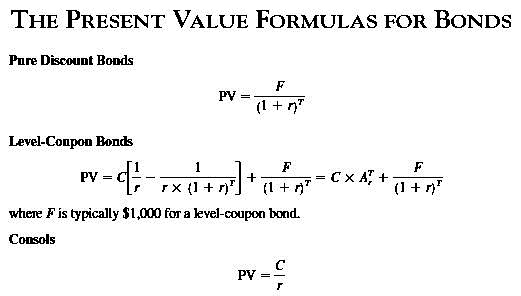

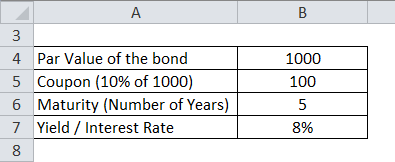

Coupon Bond Formula | How to Calculate the Price ... - WallStreetMojo The formula for calculation of the price of this bond basically uses the present value of the probable future cash flows in the form of coupon payments and the ... Bond Coupon Interest Rate: How It Affects Price - Investopedia The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. · If a coupon is higher than the prevailing ...

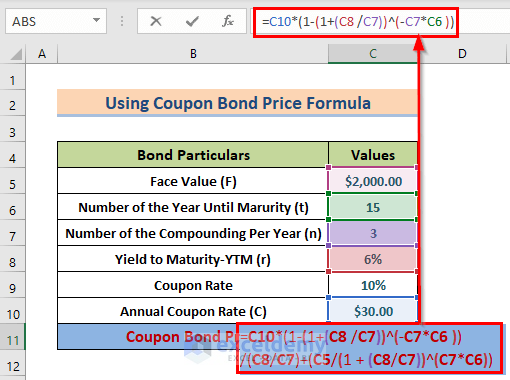

Formula to Calculate Bond Price - WallStreetMojo The coupon payment during a period is calculated by multiplying the coupon rate and the par value and then dividing the result by the frequency of the coupon ...

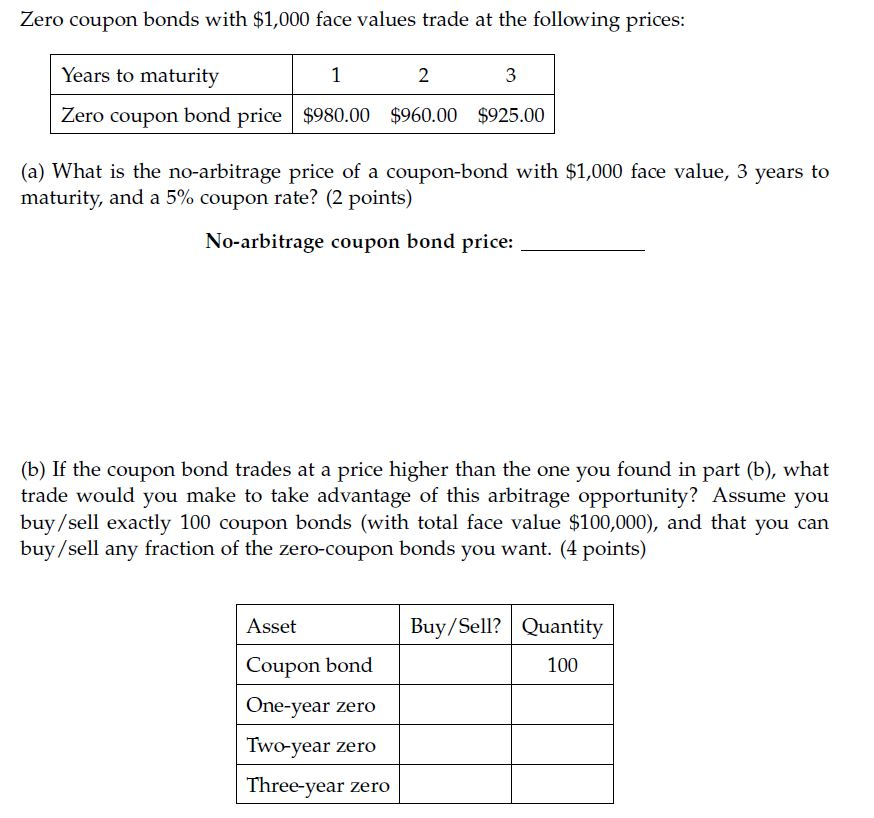

Price of coupon bond

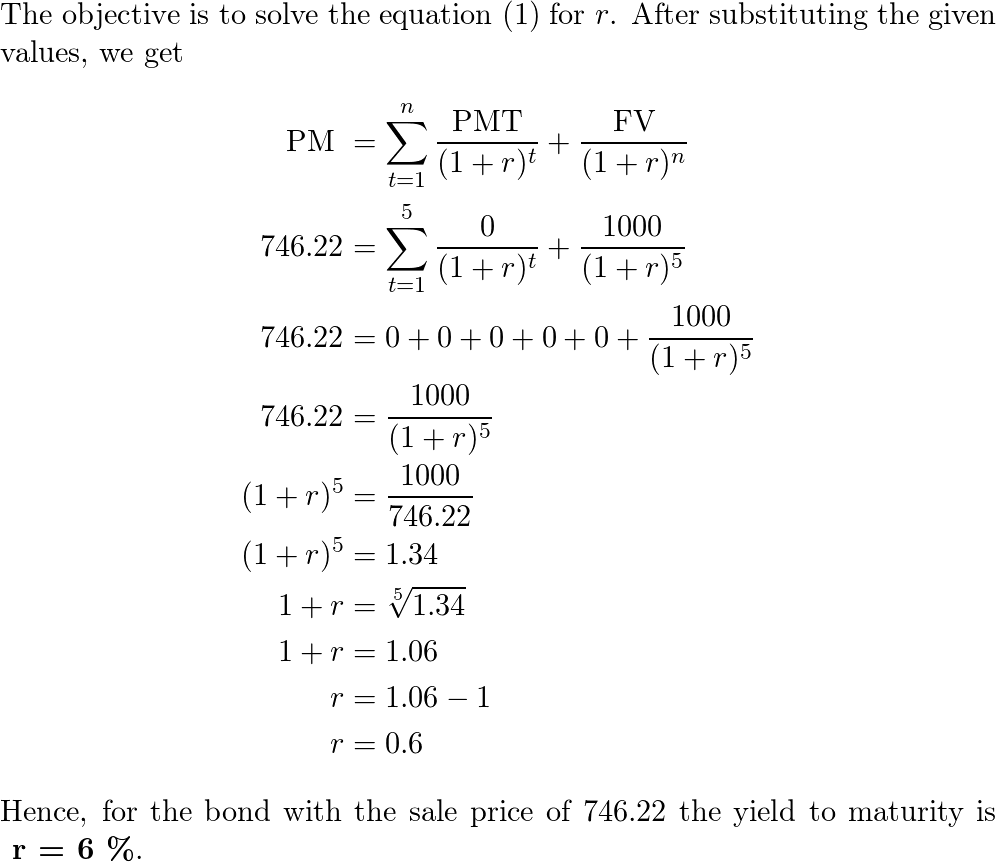

Bond Price Calculator | Formula | Chart Annual coupon rate: 5%; Coupon Frequency: Annual; Years to maturity: 10 years; Yield to maturity (YTM): 8%. The bond valuation calculator follows the steps ... Coupon Bond Formula | Examples with Excel Template - eduCBA Coupon Bond Formula ; Formula; Examples ; C = 5% * $1000; C = $50 ; Coupon Bond = $50 * [1 – (1 + 6%/1) -1*9] + [$1000 / (1 + 6%/1) · Coupon Bond = $932 ; C =(5%/2) ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or “par ...

Price of coupon bond. Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a ... Bond Pricing - Corporate Finance Institute Oct 26, 2022 ... A bond may or may not come with attached coupons. A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. How to calculate bond price in Excel? - ExtendOffice Select the cell you will place the calculated price at, type the formula =PV(B20/2,B22,B19*B23/2,B19), and press the Enter key. Note: In above formula, B20 is ... Coupon Bond Price - YouTube Aug 3, 2014 ... How to calculate the price of a coupon bond.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or “par ... Coupon Bond Formula | Examples with Excel Template - eduCBA Coupon Bond Formula ; Formula; Examples ; C = 5% * $1000; C = $50 ; Coupon Bond = $50 * [1 – (1 + 6%/1) -1*9] + [$1000 / (1 + 6%/1) · Coupon Bond = $932 ; C =(5%/2) ... Bond Price Calculator | Formula | Chart Annual coupon rate: 5%; Coupon Frequency: Annual; Years to maturity: 10 years; Yield to maturity (YTM): 8%. The bond valuation calculator follows the steps ...

Post a Comment for "40 price of coupon bond"